One Person, One $Billion?

Advances in AI have opened up the possibility of billion-dollar companies with solo founders or minimal teams. New automation tools allow founders to build products and run complex operations with smaller staffs, fundamentally rewriting startup economics with remarkably lean operations.

When serverless computing first emerged (remember serverless?), there was speculation around the idea of a "billion dollar function", where given the ability to easily scale serverless code, someone might be able to create a single "do something tool", an API likely, that would be extremely valuable. Like, worth a billion dollars valuable.

What's a function? Any singular task really.

Functions are "self contained" modules of code that accomplish a specific task. Functions usually "take in" data, process it, and "return" a result. Once a function is written, it can be used over and over and over again. Functions can be "called" from the inside of other functions. [5]

While we've certainly seen small companies sold for billions of dollars, Instagram being the canonical example, I'm not sure we've ever seen, or will ever see, the billion-dollar function. However, we will certainly see more companies with small teams and billion dollar valuations, and that is even more likely today.

Instagram launched 10 years ago. By the time it was bought by Facebook in 2012, it only had 13 employees [4]

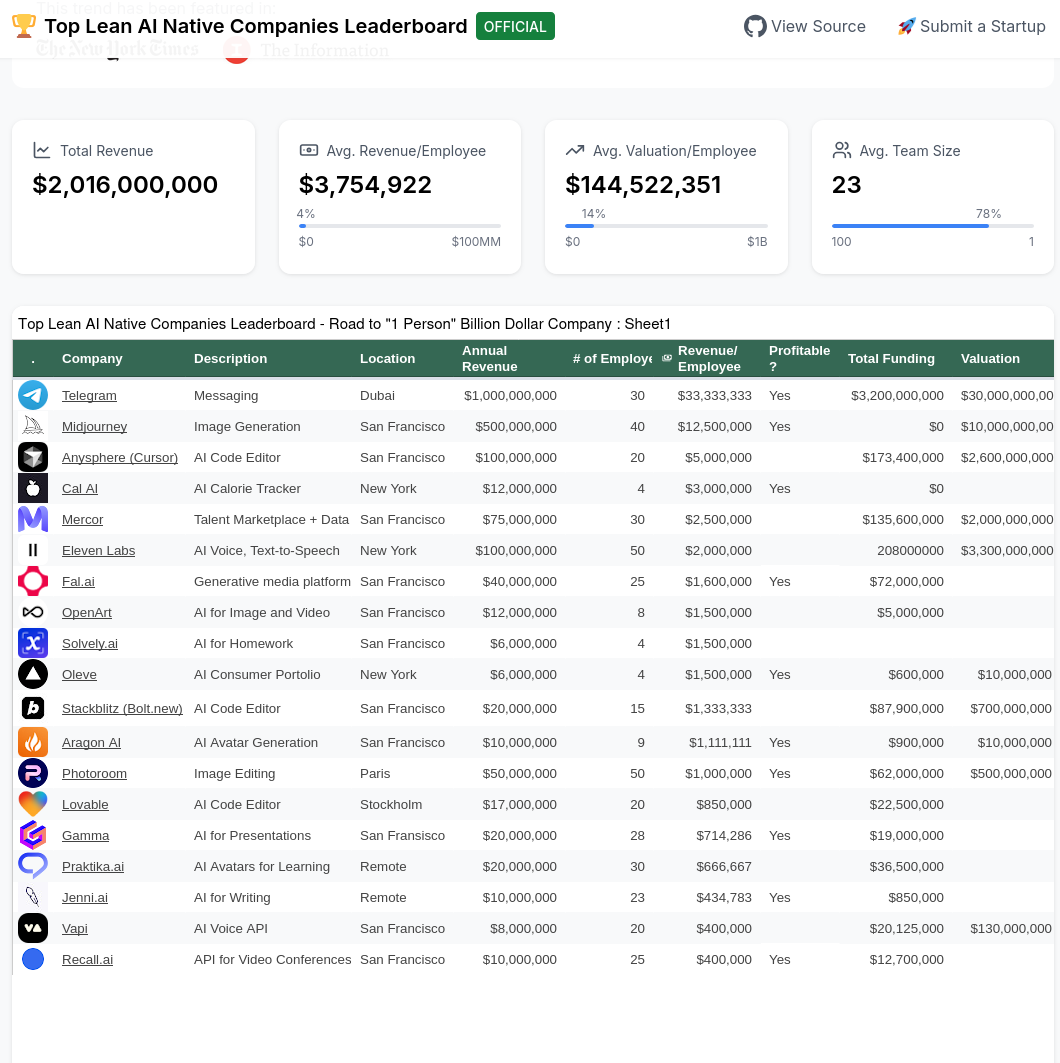

Recent advances in AI have definitely had an impact on how small companies can grow rapidly, as evidenced by the Top Lean AI Native Companies Leaderboard [3].

Leaderboard qualifications:

- Over $5MM ARR (run rate)

- Under 50 employees

- Under 5 years old

- Exceptions can be made for prominent startups with more than $1MM ARR/employee

Small Teams

Many of these companies have very small teams, and are seeing explosive growth.

...Gamma, which makes software that lets people create presentations and websites, has no need for more cash, Mr. Lee said. His company has hired only 28 people to get “tens of millions” in annual recurring revenue and nearly 50 million users. Gamma is also profitable. “If we were from the generation before, we would easily be at 200 employees,” Mr. Lee said. “We get a chance to rethink that, basically rewrite the playbook.” [8]

Historically, Silicon Valley venture capital has focused on scaling companies by injecting massive amounts of cash and engaging in huge hiring binges to get the company to a point where it can generate larger revenues leading to higher valuations. But there are now other options to that playbook, as laid out in the New York Time article and elsewhere.

One Person One Billion

A decade ago we would've thought a single-person-company had no chance of reaching a billion dollar valuation. But now thanks to all this AI, it is. [9]

Could a single person create a billion-dollar company? This question becomes more relevant as generative AI and programming automation tools and assistants democratize business capabilities that once required entire companies.

A billion-dollar valuation typically stems from funding rounds or revenue multiples. For fast-growing startups (those expanding at 100% annually), investors often apply a 5-20x revenue multiplier. At the high end, this means a company with $50 million in annual recurring revenue (ARR) could justify a billion-dollar valuation.

While the $50 million ARR target sounds enormous for a single-person operation (it is $136,986 per day), AI tools, automation and digital distribution have significantly lowered many operational barriers. However, the enterprise market presents substantial obstacles that technology alone can't easily solve, and many of these companies are business to consumer, as opposed to business to business, where the real money usually is.

Speed of Distribution

In many cases, the speed of adoption is astonishing. We're not used to seeing large numbers of people adopt an application so quickly, and OpenAI's ChatGPT is a stunning example.

ChatGPT, the popular chatbot from OpenAI, is estimated to have reached 100 million monthly active users in January, just two months after launch, making it the fastest-growing consumer application in history, according to a UBS study on Wednesday. [6]

ChatGPT, OpenAI's popular chatbot, is estimated to have reached 100 million monthly active users in January, just two months after launch, making it the fastest growing consumer application in history, according to a study by UBS on Wednesday. [10] And it's not just a web app, it's major applications like IDEs (programmer development environments, i.e. big, massive tools).

AI is the Function

What is an "AI native" company? A wrapper around a big language model? This is part of the problem, because the reality is a bit more complex.

On the one hand, a lot of wrapping is needed. A ton of code and a lot of technology has to be written around generative AI to make it useful. Generative AI is not magic, and often it's not even good, yet it can do things that weren't previously possible. In these cases, AI is the function.

It will take a while to figure out what that means. Some companies, like Cursor, have had to do a lot of work to make AI useful, to make it cost effective, not to mention building all the tools, and of course the ability to fork Visual Studio Code (an open source IDE–no VSCode, no high speed development from Cursor).

Conclusion

The most realistic scenario for these hyper-efficient solo or small team operations is 1) being B2C and 2) acquisition by much larger, established, multinational companies, ala what happened with Instagram. With all this in mind, it certainly seems possible for an individual, or more likely a small team, to achieve $50 million ARR and be acquired for $1 billion, and, what's more, that the likelihood of this occurring is higher now than it has ever been.

That said, a billion dollars isn't what it used to be, so it has to be easier than a decade ago.

$750,000,000 in 2012 (when Instagram was acquired) is worth $1,037,715,489.08 today [7]

The ability to create this kind of organisation is getting easier, and while Instagram is a great example, it is still one of the few. But times have changed. AI co-pilots, advanced coding tools like Cursor et al, relatively cheap, scalable, and highly abstract infrastructure, and digital distribution have fundamentally changed what's possible. In response, VCs have changed their playbook. Further, startup founders may not want too much money at the beginning. Plus, a billion just ain't what it used to be!

Related Posts

Further Reading

[1]: https://x.com/benln/status/1890413609768956015

[2]: https://www.whatshotit.vc/p/whats-in-enterprise-itvc-435

[3]: https://leanaileaderboard.com/

[4]: https://www.businessinsider.com/instagram-first-13-employees-full-list-2020-4

[5]: https://users.cs.utah.edu/~germain/PPS/Topics/functions.html

[7]: https://www.in2013dollars.com/us/inflation/2012?amount=750000000

[8]: https://www.nytimes.com/2025/02/20/technology/ai-silicon-valley-start-ups.html