Open on Thursday, Closed on Sunday

The last couple years have shown unprecedented speed of change: SVB collapsed within days through group chat coordination, while ChatGPT reached global adoption almost instantly. Yet we may be hitting natural limits—not technical ones, but human capacity to process and adapt to such rapid shifts.

...bottoms happen quicker today. I think information transfers so fast...the regulators have very little time to react. You think about Silicon Valley Bank: well that was open on a Thursday, closed on a Sunday. - Harvey Schwartz on the The Compound

I was listening to a financial podcast over the holidays, and part of the discussion on the show was remembering back in 2023, which seems like a thousand years ago now, the implosion of Silicon Valley Bank, specifically how things move so quickly now. We have a lot of fragility in our systems, whether it's banking or computing or communications, and now that fragility–the cracks that spread–are almost instantaneous. Can we react to things fast enough? Maybe, maybe not.

Timeline of the Silicon Valley Bank Collapse

The SVB was essentially closed due to a bank run, a phenomenon that occurs when a large number of customers try to withdraw their deposits from a bank at the same time, usually because they believe that the bank will fail for other reasons, but by withdrawing funds they actually cause the bank to collapse. Oops. Then we all hope that the government will step in and save our savings. (After all, what is capitalism without government loan guarantees? Without it, systemic failures would destroy savings over time, I expect).

The regulators only had a few days, a weekend no less, to respond to the bank failure, otherwise the entire banking system was susceptible to the "contagion" of SVB's failure. Dire times indeed.

March 8, 2023

- SVB announces plans to raise $2.25 billion through stock sales

- The bank discloses the sale of over $21 billion worth of investments at a $1.8 billion loss

March 9, 2023:

- SVB's stock plummets by 60%

- Customers initiate massive withdrawals, triggering a bank run - possibly driven by the speed of social media and other communications

March 10, 2023:

- California regulators close SVB

- The Federal Deposit Insurance Corporation (FDIC) seizes control of the bank

March 12, 2023:

- U.S. authorities announce full protection for all depositors at SVB and Signature Bank

March 13, 2023:

- SVB reopens as Silicon Valley Bridge Bank

- HSBC acquires SVB's U.K. division for £15

March 15, 2023:

- Treasury Secretary Janet Yellen reassures Congress about the stability of the U.S. banking system

March 17, 2023:

- SVB Financial Group files for Chapter 11 bankruptcy protection

One of the many interesting things about the collapse is that there is speculation that the bank run was actually caused by the ability of a group of people to communicate quickly, i.e. a big old group chat–the ultimate social network. Was it a Twitter fed bank run? Or a WhatsApp group of wealthy founders and venture capitalists telling each other to withdraw money before the collapse?

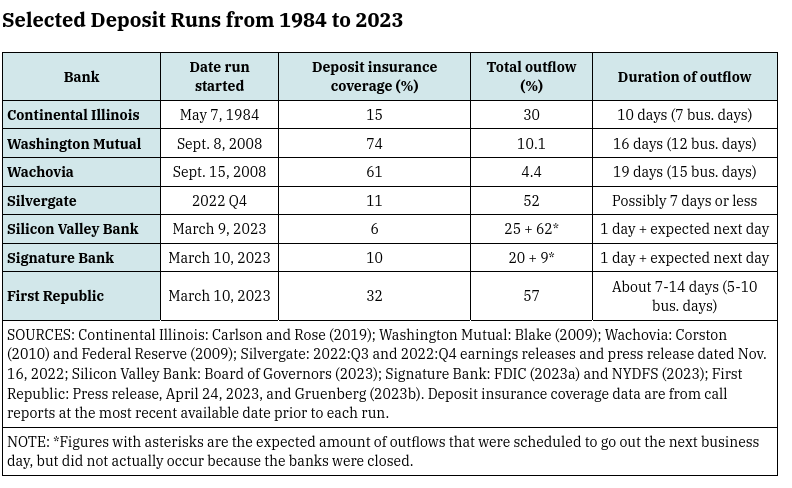

Speed is the key focus here: "Depositors raced to empty their accounts, withdrawing $42 billion in a single day." [2] An example of a previous bank run fueled collapse was Washington Mutual in 2008, which saw "...the withdrawal of US$16.7 billion in deposits during a 9-day bank run." [3]

42 billion in one day, versus 16.7 billion over 9 days. The time we have to solve systemic failures has been vastly reduced.

...the most severe run recently was at Silicon Valley Bank, which lost 25% of its deposits in one day and was closed before an additional 62% was scheduled to flow out the next. [4]

Electronic banking is a factor, but perhaps the group chat is mightier: "At such banks, if connections and similarities among depositors are especially important in driving the speed of runs, then so is supervision and regulation that gathers information about the likelihood of depositors behaving in similar ways during a crisis." [4]

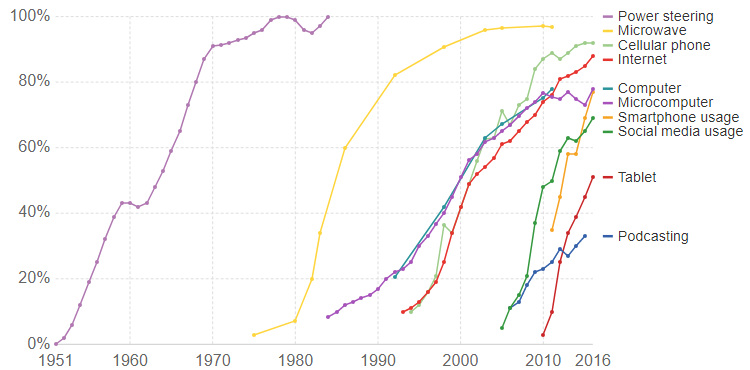

OpenAI ChatGPT Adoption Speed

ChatGPT, the popular chatbot from OpenAI, is estimated to have reached 100 million monthly active users in January, just two months after launch, making it the fastest-growing consumer application in history, according to a UBS study on Wednesday. [7]

To put this adoption speed into perspective:

- ChatGPT reached 1 million users 30 times faster than Instagram, which took 2.5 months [1]

- It achieved 100 million users significantly quicker than TikTok (9 months) and Instagram (2.5 years) [1]

As of December 2024, ChatGPT's popularity continues to soar:

- The platform receives approximately 3.66 billion visits per month [1]

- Users spend an average of 6 minutes and 11 seconds per visit, viewing about 3.66 pages [1]

A new and powerful application should be able to be distributed to the world in a couple of days.

Another interesting feature of the ChatGPT release was the surprise at OpenAI around its success.

"I will admit, to my slight embarrassment … when we made ChatGPT, I didn't know if it was any good," said Sutskever. [9]

It seems that no one was more surprised by that than OpenAI itself. OpenAI president and cofounder Greg Brockman told Forbes earlier this year that the startup's staff did not think the chatbot was particularly useful and were taken aback by its sudden popularity. [9]

Conclusion

Financial failures, applications, technologies–they all spread almost instantaneously now. Financial contagion can take effect in 24-48 hours. ChatGPT was available to almost everyone immediately. How long will it take to launch the next big online application? A few hours?

That all said–have we peaked? Sure, some bitcoin currency could likely collapse in a couple of hours, but can a bank really fail that quickly? No, at least, not yet. If we can fix a failing bank in 24 hours (I mean, people still go to bed at night) AND we can handle an application, ChatGPT, that is distributed to almost everyone in the world in a few days, can we handle anything? Maybe we're doing just fine. But it's important to take a breath, take a pause, and look at how quickly things can change, and to continue to prepare our political and organisational systems, our kids perhaps, to deal with the increasing rate of change.

Further Reading

[1] - https://explodingtopics.com/blog/chatgpt-users

[2] - https://www.npr.org/2023/03/13/1163155347/svb-silicon-valley-bank-collapse-bailout-failure

[3] - https://en.wikipedia.org/wiki/Washington_Mutual

[5] - https://www.visualcapitalist.com/rising-speed-technological-adoption/

[8] - https://www.axios.com/2023/03/18/silicon-valley-bank-timeline